FIN Simple

Smart Fleet Financing

With Ford Pro™ FinSimple®

Commercial Business Financing Made Easy

Ford Pro™ FinSimple® is a one-stop shop for vehicle financing for businesses of any size. We’re connected to all aspects of Ford Pro™, bringing the resources and expertise to help your business thrive. We offer competitive interest rates, flexible repayment terms, no hidden fees, and a simplified process to get approved.

Find the right financing solutions for you.

You tell us about your business and our new intuitive tool will consolidate your info and help guide you to a solution that meets your needs. No repeat forms and no time wasted on things you don’t need. It’s a win-win 1.

Get Started

Step One

Fill out a two-minute questionnaire about your business type, size, revenue, and estimated financial need.

Step Two

We’ll make a customized recommendation of the application you need.

Step Three

Submit application and begin unlocking access to new Ford vehicles for your fleet.

Commercial Financing Options

Commercial Installment Financing

Own your vehicles with flexible financing that meets your changing business needs — a fully amortized loan, no early payoff charges, and you can sell or trade at any time.

Commercial Red Carpet Lease™

If your vehicle use is predeictable, enjoy a new Ford vehicle more often. When you return it, you’ll only cover excess wear and use charges.

Commercial Lease (TRAC)

Need vehicles for heavy use? Set the residual based on your business, with no sign-up or termination fees, no mileage restrictions or penalties, and no excess wear or use charges.

Municipal Financing

Maximize your operating budget with fixed-rate financing to expand your police, EMT, university, or airport fleets – without major cash outlays and long-term debt obligations2.

Want to simplify adding vehicles to your fleet? Apply for a Commercial Line of Credit.

Our Commercial Line of Credit will allow you to grow your fleet at your own pace and free up capital to invest in other areas of your business3.

Ford Pro™ FinSimple® Testimonials

Expert Setup and Support

Combining fleet financing with Ford Pro™ Telematics made the setup process seamless for busy commercial roofing contractor Jolly Roofing and continues to help manage their growing fleet.

Financing for Expansion

As an established telecommunciations business, Motive Companies is building a national footprint. We provided the advantage of commercial fleet financing options to help them grow at their own pace.

Helping every step of the way.

Building Your Fleet

- Competitive interest rates and flexible repayment terms

- Simplified approval process, with no hidden fees

- Financing upfitting equipment

Our financing plans cater to the needs of your business.

No duplicative forms, wasted time, or unexpected charges.

Find an upfitter for a tailored financing plan that covers up to 100% of the cost.

Managing Your Fleet

- Combined billing

- Dedicated Specialists

To simplify payments, select all your vehicles and pay for them simultaneously.

Our experts understand your growing business needs and are here to help.

Expanding Your Fleet

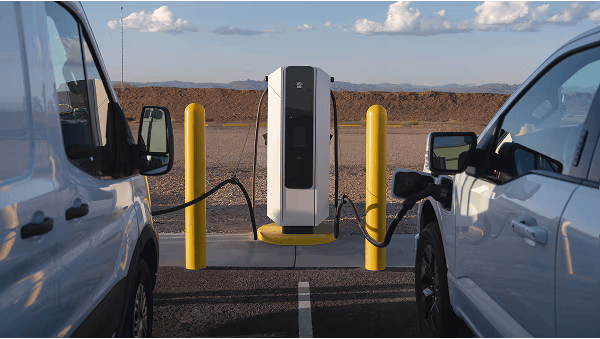

- Transitioning your fleet to electric vehicles

- Integration with Ford Pro™ products and services

- Grow at your own pace with a Commercial Line of Credit

We can help you switch or expand. Learn More about financing charging infrastructure or get our eGuide for switching to EVs.

Need to service your vehicles and avoid downtime? Need to monitor your growing fleet? We help connect all the solutions from Ford Pro.

Our simplified CLOC process lets you add vehicles as needed.